More Profit by Avoiding Failed Payments with Pixel Manager for WooCommerce

If you're running an online store, failed payments are more than just an inconvenience - they're a serious drain on your revenue.

After reading this blog post, you'll clearly understand how to prevent tracking issues and how Pixel Manager for WooCommerce automates the process for you.

Every time a payment doesn't go through, you're not just losing that transaction, you're losing a potential customer not to mention future revenue. Even a single failed payment can result in missed sales, damaged trust, and wasted ad spend.

With this in mind, in this article, let's take a closer look at the reasons behind payment failures in WooCommerce and the consequences for your business. I'll explain how Pixel Manager for WooCommerce can help you track, measure, and recover lost sales, and share actionable strategies to optimize your payment processes and keep customers coming back for more.

Why do payments fail in WooCommerce, and how does it impact my business?

I think you'll agree when I say that payment failures are incredibly frustrating. At the surface level, a failed transaction means a lost sale but the real cost runs deeper. It distorts your data, skews your marketing decisions, and wrecks your return on ad spend (ROAS).

So, why do payments fail?

There are three main culprits behind failed transactions:

- Technical issues: Payment gateway downtime, API failures, or conflicts with WooCommerce plugins can disrupt transactions.

- User errors: Expired credit cards, mistyped details, or insufficient funds lead to declined payments. These are all human errors.

- Payment gateway limitations: Some gateways have strict fraud filters or don't support certain currencies and payment methods.

The business cost of failed transactions

When a payment fails, it's not just one sale slipping through the cracks. It's a lost customer, wasted ad spend, and a misleading view of your store's performance.

Without Pixel Manager for WooCommerce, failed transactions aren't tracked, meaning the conversion data you're collecting is inaccurate. You might think your ROAS is tanking when, in reality, many of those “lost” conversions were just failed payments.

The problem with this is that it leads to bad budget decisions and ineffective ad spend.

With Pixel Manager for WooCommerce Pro, however, those lost sales are still tracked, giving you the accurate data you need to make smarter, more profitable decisions. So, instead of misallocating your ad budget, you'll know exactly what's happening and adjust accordingly.

How can I measure payment failures accurately in my store?

As they say: if you can't measure it, you can't fix it.

Payment failures are inevitable, but the real problem is not knowing when they happen. Without accurate tracking, you're flying blind - misjudging conversion rates, misallocating ad spend, and making poor business decisions.

What is payment gateway accuracy?

Payment gateway accuracy is the ability to correctly track and report both successful and failed transactions. Most ecommerce stores only see completed payments, meaning failed payments disappear from their data, skewing performance metrics.

Here's an example:

Let's say you're running Facebook Ads. Your ad manager reports 10 conversions, but in reality, 15 people attempted to buy - 5 of them just had payment failures.

Without tracking those failed transactions, you might think your ad campaign is underperforming when, in reality, your ROAS is better than it seems.

Payment gateway accuracy with Pixel Manager for WooCommerce

Pixel Manager for WooCommerce ensures that every failed transaction is logged and analyzed. It captures detailed data on why a payment didn't go through - whether it's insufficient funds, an expired card, or a gateway issue.

With Pixel Manager for WooCommerce Pro, you can view failed transactions directly in your dashboard. This means you're not just tracking sales but you're also tracking buyer intent. Instead of misreading your data and cutting ad spend prematurely, you get the full picture, allowing for smarter budget decisions.

By accurately measuring payment failures, you're already ahead of the competition. Next, let's talk about how to recover lost revenue from those failed payments.

Here's what Pixel Manager for WooCommerce automates:

| Automation Feature | How It Helps |

|---|---|

| Failed Payment Tracking | Logs failed transactions so you can analyze and address them. |

| Accurate Conversion Reporting | Ensures ad platforms get precise sales data, preventing wasted spend. |

| Automatic Conversion Recovery | Recovers lost purchase data when customers revisit the site. |

| Detailed Payment Reports | Shows which payment methods perform best for your store. |

| Payment Gateway Accuracy | Tracks both successful and failed transactions for better insights. |

| Ad Performance Optimization | Helps allocate ad budget effectively by tracking real ROAS. |

What is automatic conversion recovery and how can it help prevent revenue loss?

Failed payments don't have to mean lost revenue. With Automatic Conversion Recovery, you can track and recover abandoned transactions before they slip away for good.

How Automatic Conversion Recovery works in Pixel Manager for WooCommerce

Automatic Conversion Recovery (ACR) ensures your ad tracking remains accurate by recovering lost purchase conversion data. Many tracking pixels can only log purchases if the customer reaches the order confirmation page, but real-world data shows that shops rarely track 100% of conversions, often missing 2% to 10%.

Automatic Conversion Recovery automatically detects untracked purchases and logs them when the customer revisits the shop with the same browser within 30 days. This means your ad campaigns get more accurate data, improving optimization and ROAS.

Here's an example to better understand how this works:

Let's say a customer completes a purchase but tracking fails. Automatic Conversion Recovery detects the missing conversion and recovers it on their next visit.

You can increase Automatic Conversion Recovery's effectiveness by encouraging users to revisit your shop through personalized email campaigns or incentives.

With Automatic Conversion Recovery, you recover lost revenue, improve conversion rates, and maximize your ROAS by ensuring no potential sale goes unnoticed.

What is the cost of failed payments for my business?

Failed payments don't just hurt your sales. They create a ripple effect of lost revenue and missed opportunities. In other words, the cost you're paying isn't just one failed transaction, it's the potential lifetime value of that lost customer. Ouch.

The compound opportunity cost

When a customer's payment fails, they might not come back. You don't just lose one sale - you lose future sales, referrals, and long-term revenue.

Let's say a customer tries to buy a $150 product, but their payment is declined. Frustrated, they abandon their cart and buy from a competitor instead.

If they had made five more purchases over the next year, that's a $750 lifetime value lost all because of a single failed payment.

Consequences of failed payments for businesses

Let's sum up the consequences businesses face each time a payment fails:

- Immediate revenue loss: A failed payment means no money in your account. Zip. Zilch. Zero.

- Damaged customer trust: Customers may assume the issue is with your store, not their payment method. They're unlikely to return or recommend your store to friends and family.

- Harmed brand reputation: Too many failed transactions create a bad buying experience for customers. This negatively impacts your brand reputation.

- Missed advertising opportunities: Without accurate data, you might think your ads are failing and cut a campaign that's actually driving high-intent traffic.

This is why tracking failed payments accurately with Pixel Manager for WooCommerce is essential. It ensures you get the full picture and don't waste valuable marketing spend.

How can I optimize payment gateway accuracy to avoid failed transactions?

Every failed payment is a lost opportunity. But here's the good news: you can reduce failed transactions and increase successful payments by optimizing your payment gateway setup.

Tips for improving payment gateway success rates

Here are some of my best tips for improving payment gateway success rates:

- Ensure customers are aware of payment limits: Display a note below the payment option informing them of transaction limits.

- Highlight potential issues upfront: Educate customers about:

- Bank restrictions: Some banks block international transactions.

- Maxed-out credit cards: Encourage users to check their balance before attempting to make a payment.

- Regional payment challenges: Certain regions have low success rates with specific payment gateways.

- Prioritize successful payment options: Move high-performing gateways to the top of the selection list and consider removing low-success options.

- Offer alternative payment methods: Provide PayPal, Stripe, or other solutions to give customers more ways to complete their purchase. Stripe, for instance, boasts a 95% success rate, making it a solid choice for reducing failed payments.

💡 Pro tip: Optimize payments for high-ticket products

For orders over $1,000, consider the following:

- Encourage bank transfers: Use a pop-up explaining how customers can save 2-3% in fees by choosing direct bank transfers instead of credit cards. For a six-figure business, this could mean the cost of a BMW per year in savings!

- Negotiate lower payment processing fees: Did you know you can contact Stripe (or your payment provider) to negotiate lower rates? Even moving from 2.5% to 2.2% can have a massive impact annually.

By optimizing your payment gateways, you're not just reducing failed payments but you're also increasing revenue without spending more on ads.

How can I address failed payments proactively and improve customer retention?

Failed payments don't have to mean lost customers. The key is acting fast and making it easy for shoppers to complete their purchases.

Remember: a proactive approach can turn failed transactions into recovered revenue and loyal customers.

Best practices for preventing failed payments

- Notify customers immediately: Send an automated email or SMS when a payment fails, explaining the issue and offering a quick solution.

- Make retrying effortless: Include a direct payment link in the email or SMS so they can complete their purchase without starting over.

- Use pop-ups for high-value transactions: If an order is over $1,000, display a pre-checkout pop-up suggesting the best payment option (e.g. bank transfer to save fees).

- Send abandoned cart links: Remind customers of their saved cart so they don't have to re-add items.

- Offer alternative payment methods: If a credit card fails, suggest using PayPal, Stripe, or bank transfer as a backup option.

By reducing friction and offering quick solutions, you retain more customers and recover lost sales, ensuring your revenue keeps flowing.

Conclusion

Failed payments don't just hurt your revenue, they distort your data leading to misguided budget decisions and missed opportunities. But with Pixel Manager for WooCommerce, you can track and recover lost conversions, ensuring you make informed decisions based on accurate tracking data.

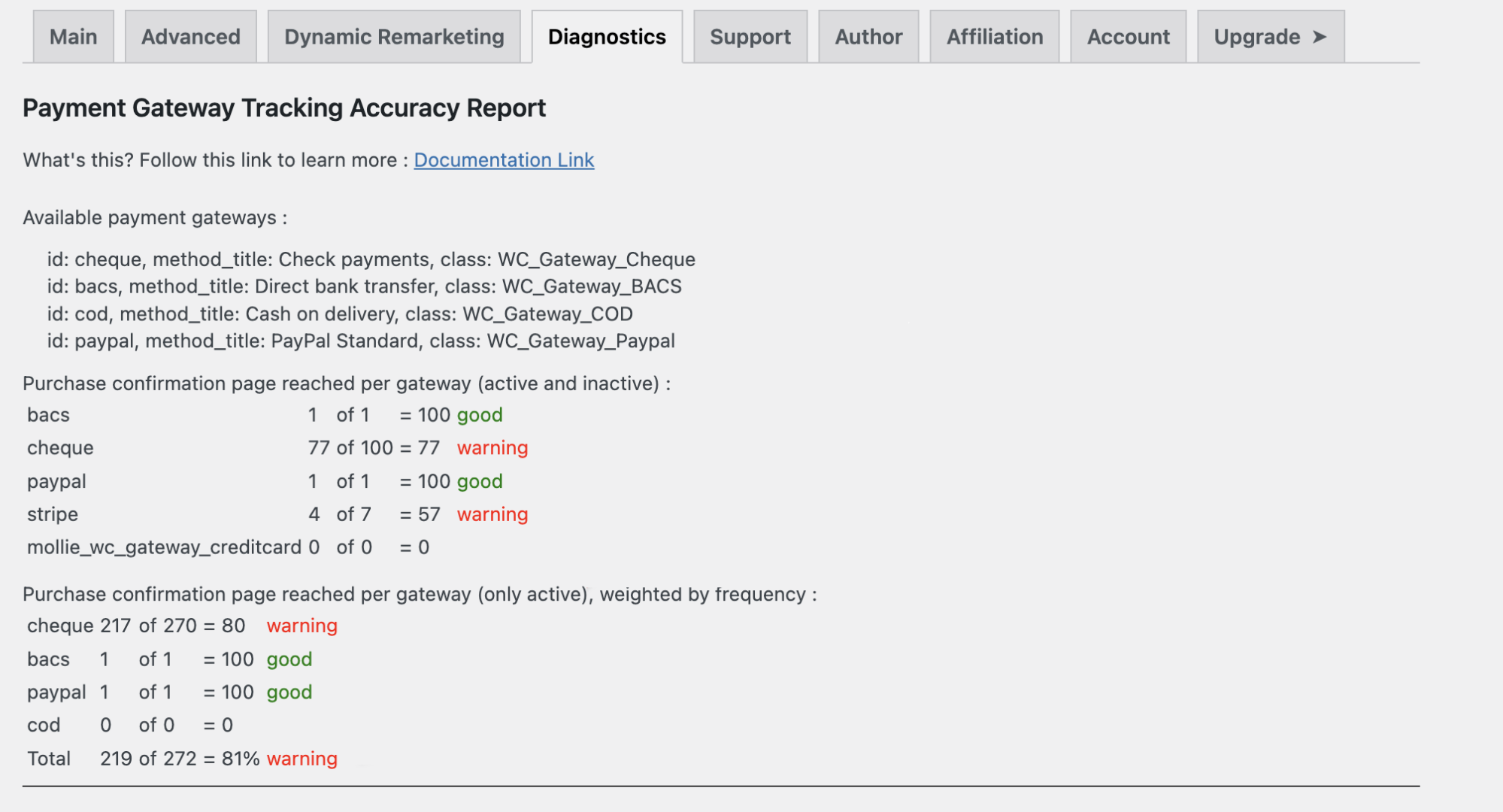

With Pixel Manager for WooCommerce Pro, you can track conversions even when a payment fails. This means you're not flying blind. You see the real ROAS of your ads which allows you to allocate budget effectively instead of cutting campaigns that are actually working. Plus, both the free and Pro versions of Pixel Manager for WooCommerce provide a detailed payment success report right in your WordPress dashboard, showing which payment methods perform best for your business.

To recap, what does this mean for your business?

- Remove low-success payment options, improving customer experience and reducing friction at checkout.

- Prioritize high-success gateways, increasing completed transactions and boosting revenue.

- Recover failed payments with Automatic Conversion Recovery, ensuring fewer lost sales and higher retention.

The result?

More sales, better customer retention, smarter ad spend, and higher profits.

If you're serious about reducing failed payments and maximizing revenue, install Pixel Manager for WooCommerce today and take control of your payment data.